Attorney Pay

Xceleran Pay: For law firms of all sizes, the most cost-effective attorney-merchant account systems are available, as well as the maximum flexibility for small firms or single lawyer firms.

We Help Legal Innovators Automate the Movement of Money

Confido Legal is an integrated payment processing platform specifically designed for law firms and legal technology companies.

Xceleran - CEC

Business Life Cycle management from customer acquisition to payment management. Get more business, keep more of your money, and build brand loyalty.

Know your numbers

At a glance, you can see recent history, current status, and future bookings. You can also see sales by each.

You set the Months you want to see in Settings/Company Information.

Take a quick view of New Bookings, Booking Unpaid, New Customer Registrations, and Pending Bookings with a multicolor graph view of your business performance.

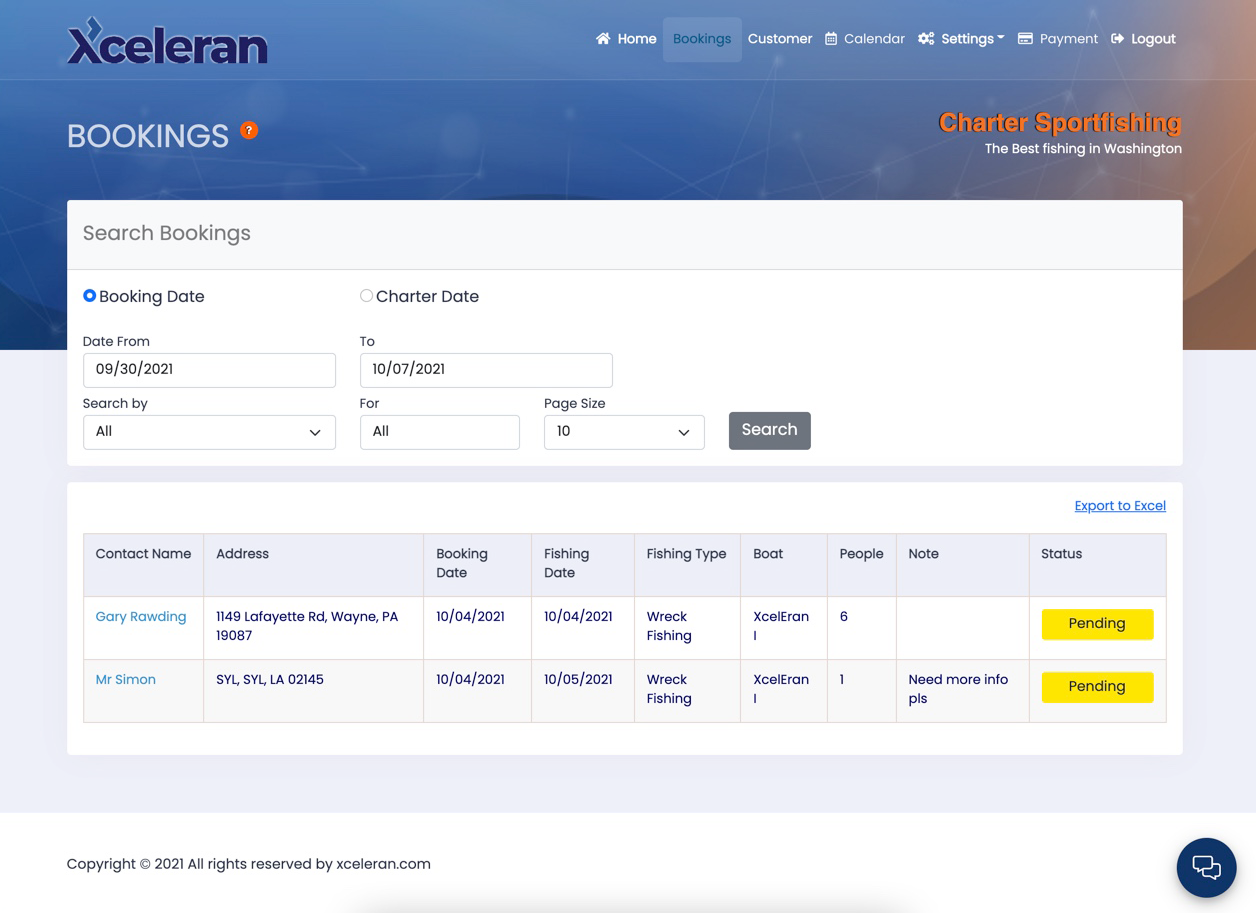

Easy Booking Management Interface

All Booking Requests are saved to this tab. From here you can sort, edit, and change assigned tasks.

- Appointments can be retrieved based upon your criteria.

- You can view your bookings by the date they were booked.

- You can export any search to Excel.

Daily Manifest

A daily manifest can easily be created by selecting the Date and entering the date of the job in both the Date From and To boxes. Click search and then export to excel for a full list of customers for the day, including notes and payment information.

PLEASE NOTE: Bookings can be created from the Customer Calendar or the CEC Calendar Tab.

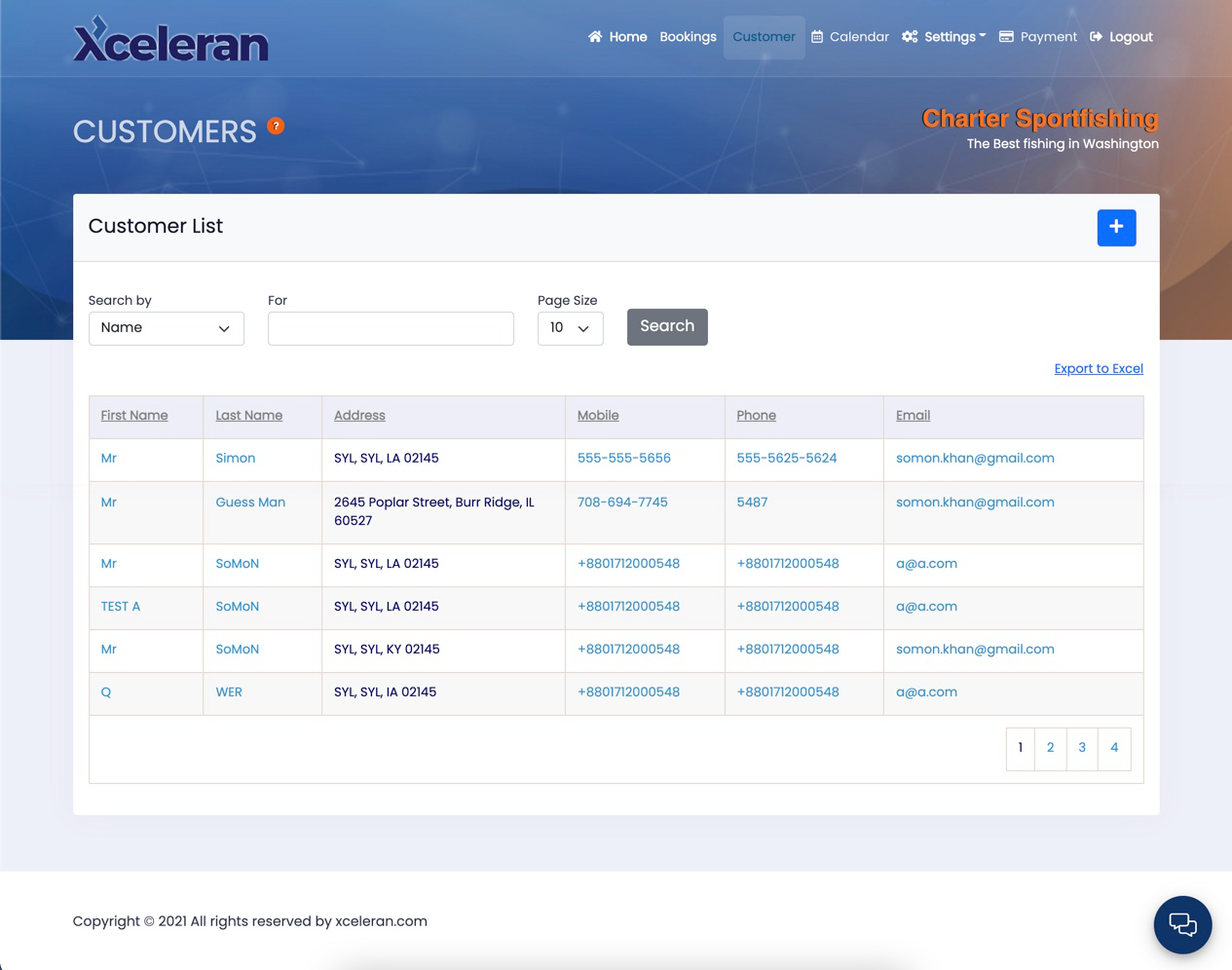

Customer Management

In the Customers tab, you can find customer details, add a new customer, create a booking, and link to an email or telephone.

- Use the search bar to search for customers.

- Click a name to open details or to create a new booking for this customer.

- If you are on your mobile device or have a computer phone source like myServicePhone or Skype Phone you can click to autodial.

- Click on the email address, and you will open your default email.

- Customers are added automatically when they request a Booking.

- You can also manually add customers or create a Booking for them directly.

- Export to Excel file option is available.

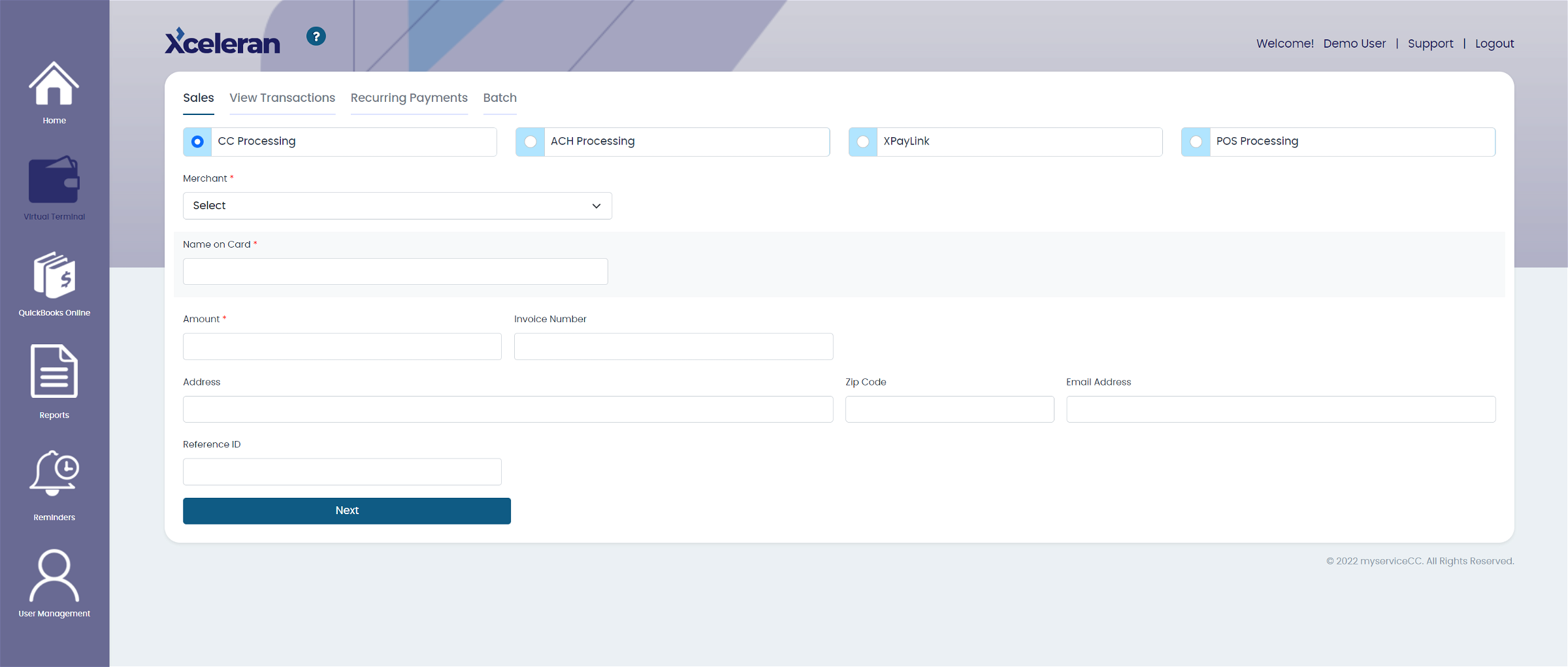

Payment Management

Main Features

- XPayLink allows a deposit to be collected when the booking is made.

- XceleranCC-Virtual Terminal features

- 4 ways to manually collect payments including Point of Sale

- Transaction Management including Voids and Refunds

- Integrates with QuickBooks Online for easy seamless bookkeeping

- Processing cost – 2.9% + $.10/transaction or BETTER

CallPop

CallPop Intelligent Phone Answering Software:

- Gathers key current data on customer calling from Xceleran BMS. Read more

- Provides access to past history as well as makes notes. Read more

- Links to Customer Site in Xceleran BMS. Read more

- Links to XceleranCC-Virtual Terminal. Read more

* Requires approved voice-over IP phone service.

Reputation Management

Our Integrating online Reputation Management into your personalized Business Management System gives you visibility into how your customers and potential customers see you, AND as importantly a way to instantly and easily respond.

Marketing Score

Based on how your business performs in four (4) areas:

1.Reviews

2.Promotions

3.Social Reputation

4.Online Visibility

- Measure your brand’s online influence and reputation

Social Reputation Rating

The average star rating for each of the past three months. The associated “Customer Trends” button can be used to show or hide customer trends on the same graph.

- Star ratings help build trust; measure the success of your reputation-building efforts

Secure Payment Management

Our Secure Payment Management feature in XceleranCC - Payment Processing lets you to keep a client's preferred payment method safe and secure. You may quickly make a charge on their behalf, saving you time and simplifying the billing procedure. You can even keep numerous payment methods for a single client, allowing you to produce a payment the way they want it. Learn More

Unique Payment Pages

Create your own secure payment pages to make online purchases a breeze. To provide clients with a smooth payment experience, customize your payment page and link to it from emails, invoices, and your website.

Secure Gateway

Offer clients with a variety of simple payment options by accepting professional online payments through our secure gateway. Getting paid is effortless and safe, whether you submit payment requests to clients or execute transactions at your office.

Fast Billing

Clients may pay their bills fast and conveniently with just a click thanks to fast billing system. It allows you to request payment for a pre-filled monetary amount. Your client will be sent a link to a secure site where they may check their bills and pay them. From your Xceleran's account, you may manage and track bills that have been sent, viewed, and paid.

Scheduled Payments

Schedule payments in advance for regular services or retainer work, then sit back and watch the money come in. You may save time and money in your business by using our free Scheduled Payments function.

Website Payments Integration

Get your money into your hands as quickly, easily, and cost-effectively as possible by maximizing speed and ease of use via seamless integration with your:

- Bank

- Bookkeeping Software

- Electronic Payment Processor (Virtual Terminal)

Security & Anti-Fraud

There is no amount of security that is sufficient. With Xceleran, one of the most complete security systems on the market today, we go above and beyond the industry's requirements. We encrypt and remove all card data from the clear, and we back it up with a team of professionals that work around the clock to secure and teach our partners and companies.

Transaction and Batch Management

All transactions can be managed in one location using the most efficient features:

- Voids and Refunds

- Reconciliation Reports

- Customer Transaction Details